Your Crypto Credit Union (YCCU): Bridging Two Worlds

Your Crypto Credit Union

Bridging Two Worlds

Thomas K Sheppard

& Patrick Martin

July 2024

© Copyright

2024 The Skillful PM, LLC & Gilman Patrick, LLC. All rights reserved.

Don't Miss These Related Articles:

https://www.gilmanpatrick.com/lebanon-crypto-credit-union-solution/

Introduction

Taming the Frontier

In 1869 the Transcontinental Railroad was completed,

connecting the Eastern and Western United States of America. Facilitating the

movement of people, goods, and communication, the railroad played a crucial

role in integrating the Western frontier into the national economy and

fostering economic growth and development across the country (Atack, et al,

1994).

Your Crypto Credit Union (YCCU) will do for the Crypto

Econosphere what the Transcontinental Railroad did for the American West. Like

the Transcontinental Railroad before it, YCCU facilitates the movement of money

to and from the frontier of the Crypto Econosphere. With this enhanced ease of

movement, the two econospheres will be brought closer together and both will

grow. YCCU will fuel a level of economic growth that hasn’t been seen since the

period that followed the completion of the Transcontinental Railroad.

In case you missed it (see Surveying the

Terrain, below), this

is a $480-billion opportunity, right now. On the horizon, the

opportunity expands into a $120-trillion opportunity.

The first-to-market implementing this strategy may enjoy

many unforeseen benefits from being the primary driver behind Credit Union Currency (CUC™). Once

implemented, CUC™ will quickly become the de facto standard for a

cryptocurrency that is directly backed, 100%, by USD deposits.

The building of the Transcontinental Railroad didn’t depend

on any revolutionary new technology. Existing technology, backed by capital,

favorable regulations, and the dogged determination of a few individuals made

it happen. Likewise, the building of YCCU doesn’t require bleeding-edge

technology. It requires modest adaptations of existing technology, capital,

favorable regulations (which exist and are emerging), and the dogged

determination of a few individuals.

The backers of the Transcontinental Railroad benefitted

significantly from its success. However, the benefits that came to the people

who rode the rails to settle the West are incalculable. Likewise, the early

benefits for the first-to-market and early-adopters of the YCCU model, although

substantial, pale in comparison with the substantial and widespread benefits

that will derive those who use YCCU as their well-regulated and low-friction

financial bridge between the USD Econosphere and the Crypto Econosphere.

Premier Safe Haven Cryptocurrency

CUC™ will become the go-to safe haven cryptocurrency when

cryptocurrency investors want to move to a liquid position outside of the

volatile cryptocurrencies. Unlike the USD-based stablecoins, CUC™ is not driven

by obscure algorithms and opaque deposits. Being entirely based on cash

deposits, CUC™, will be the premier USD-related cryptocurrency. If the USD

Econosphere becomes unstable, YCCU will be there, enabling legal capital flight

across the bridge to cryptocurrency.

Because CUC™ is backed entirely by USD deposits in a fully

accredited, audited, and regulated credit union, deposits are insured up to

$250k by the credit union equivalent of the FDIC, the NCUSIF. No other

USD-pegged stablecoin has that advantage.

Legal Anonymity and Privacy

Membership in YCCU, validated through compliance with KYC

regulations, is not a matter of public record. CUC™ is a private blockchain, so

the transfer of CUC™ between members is not on the public record, unlike

transactions on the Bitcoin and Ethereum blockchain networks. The membership

and transaction history of members within YCCU can only be obtained by outside

parties with lawful warrants, controlled by US courts and carried out by US law

enforcement agents.

Member’s Only Bridge Access

The liquidity bridge between USD and Crypto Econospheres,

that is YCCU, is only accessible by members of YCCU. There are no stampedes.

Transactions between YCCU members, although subject to

regulatory oversight, is invisible outside of YCCU and gas fees incurred will

be lower than those on a public blockchain.

Private, Regulated Blockchain

The private nature of the CUC™ blockchain, and its integral

role in the YCCU architecture means that this is the only governmentally

regulated blockchain in the world. There

are no opportunities for front running or any other unethical or illegal

transaction arbitrage schemes that abound in the Crypto Econosphere.

Because YCCU is a properly licensed, regulated, and audited

credit union under US laws and regulations, a rug pull isn’t possible with

YCCU. Current banking and credit union regulations prevent that. The principals

in the institution don’t have the ability to pull what Sam Bankman Freid did. Within

FTX, he had no oversight and no segregation of duties. Credit unions are

required to have oversight and segregation of duties.

Member’s Only Treasury

Perhaps one of the most exciting opportunities that YCCU

offers exclusively to members who are businesses are treasury management functions

that span both econospheres.

Although not widely known, credit unions have launched

treasury management services that include automated clearing house (ACH)

transactions, remote deposit capture, wire transfers, and fraud prevention

tools. These services help businesses streamline their payment processes,

improve cash flow, and enhance security (Credit Union Connection, 2023). YCCU

offers the opportunity to bring these treasury management services into the

Crypto Econosphere.

YCCU treasury management services will have a high degree of

privacy because all treasury exchanges are performed by YCCU on behalf of

collective membership. YCCU is the on-chain alias.

Alias

YCCU is the on-chain alias because, when YCCU moves money as

part of a treasury management function, the public blockchain shows transactions

to and from YCCU. The underlying transactions with the specific member account(s)

are recorded on the private CUC™ blockchain. The information is available to

satisfy a legal subpoena, but otherwise is not visible to the public. This is a

sharp contrast to the public nature of the Ethereum and Bitcoin blockchains,

where all transactions are visible to everyone who cares to look.

The New Frontier

The emergence of the cryptocurrency-based econosphere[i]

is obviously one of the biggest disruptors to the current USD-based Econosphere

since the abandonment of the gold standard. While banks are currently

ill-suited to entering the Crypto Econosphere, the basic regulatory and

operational design of the credit union lends itself to becoming a premier

financial bridge between these two econospheres.

While many in the crypto space vociferously repudiate

governmental financial regulation, increasingly they are realizing that the

biggest barrier to the adoption of their beloved cryptocurrencies is the

extreme legal uncertainties of the cryptocurrency econosphere.

The arrival of US Marshalls, local sheriffs, and the US Army

was the beginning of the transformation from the Wild West into someplace

ordinary people wanted to live. It was cemented when the West became safely and

easily accessible by the arrival of the railroad.

Singular Opportunity

The absence of a trusted and well-regulated bridge between traditional

financial services and the worldwide cryptocurrency market represents a

singular banking opportunity.

This paper sets out the opportunity and outlines the path to

create an NCUA chartered Federal credit union built on the blockchain and

serving the needs of people around the world who want / need to keep one foot

in the Crypto Econosphere and the other in the USD Econosphere.

Creating Your Crypto Credit Union (YCCU)

In Banking on the Blockchain, published back in May

of 2024, Thomas Sheppard wrote, “I see the greatest opportunity for immediate,

effective application of these technologies specifically in the realm of Credit

Unions.” Now, we will explore in more detail how to build “Your Crypto Credit

Union” (YCCU).

If some of the cryptocurrency terms we use are unfamiliar,

you may want to look them up in the Key

Terms section, below.

Surveying the Terrain

Square One

In case you missed this part, credit unions are

not-for-profit institutions that provide a range of financial services,

including savings accounts, loans, and other financial products, primarily to

their members. The credit union members share a common bond, such as a

community, employer, or association.

Cryptocurrency users and investors are a worldwide community

with a common bond. They tend to be highly individualistic, independent,

mobile, and come from all walks of life. Their common bond is their belief that

blockchain technology represents a unique opportunity to create an economic

system (econosphere) that runs in parallel with the traditional financial

econosphere typified by fiat currencies.

Crypto Users Profile

The profile of the typical cryptocurrency user can vary widely,

but several common characteristics and trends have been identified through

various studies and surveys. Here’s a general overview of the typical

cryptocurrency user profile, along with few salient facts:

Locations: Cryptocurrency

users are found worldwide, with significant concentrations in regions such as

North America, Europe, and parts of Asia. Emerging markets are also seeing

increased adoption.

Age: Cryptocurrency

users are generally younger compared to traditional financial service users.

Studies indicate that the majority of cryptocurrency users are between the ages

of 18 and 44. This younger demographic is more tech-savvy and open to

new financial technologies. (Pew, 2023)

Gender: The

cryptocurrency user base has historically been predominantly male. Recent data

shows that around 70-80% of cryptocurrency users are male, although female

participation in this space is increasing. (Statista, 2024)

Income: Cryptocurrency

users often have higher income levels compared to the general

population. They are typically individuals with disposable income who can

afford to invest in speculative assets like cryptocurrencies. (Chainalysis,

2024)

Behaviors: Behaviorally,

crypto users tend to be more technologically inclined and comfortable

with digital platforms. They are familiar with online trading platforms and

digital wallets, and they often use technology to manage their investments.

(Deloitte, 2023)

Investors: Many

cryptocurrency users view cryptocurrencies as an investment rather than a

currency for everyday transactions. They are often interested in speculative

trading, seeking high returns on their investments (eToro, 2023). Cryptocurrency

users generally have a higher risk tolerance. They are willing to invest

in highly volatile and speculative assets, understanding the potential for

significant gains as well as losses. (Fidelity, 2023)

Consumers: A survey

conducted by Pew Research Center in 2023 (Pew, 2023) found that 32%

of cryptocurrency users are interested in migrating most or all their financial

transactions to cryptocurrencies. This indicates a significant portion of users

are inclined toward adopting digital assets as a primary means of financial

management.

Crypto Users Conclusions

Despite the enthusiasm, 40% of cryptocurrency users

acknowledge barriers to fully migrating to cryptocurrencies, such as regulatory

concerns, volatility, and limited acceptance among merchants, according to a

survey by eToro (eToro, 2024). These factors contribute to the cautious

approach of many users who may not yet be ready to fully transition away from

traditional financial systems.

The Crypto Econosphere

The nascent cryptocurrency financial market (Crypto

Econosphere) is a natural extension of the precepts and operations of credit

unions. The Crypto Econosphere is also a significant market opportunity for a

trustworthy financial institution.

Size of the Crypto Community

As of mid-2024, the total market capitalization of all

cryptocurrencies globally is approximately $1.5 trillion (CoinMarketCap,

2024). This figure represents the combined value of all cryptocurrencies in

circulation and fluctuates based on market conditions.

In the US, the cryptocurrency market is also robust, with a

significant number of investors and users. According to Statista (2024), the

market capitalization of cryptocurrencies in the US alone is estimated to be

over $500 billion, reflecting a substantial portion of the global market.

The US continues to be a major player in cryptocurrency

adoption. A report by Pew Research Center (2023)

highlights that approximately 16% of Americans have invested

in or used cryptocurrencies, indicating widespread engagement and investment in

the sector.

The increasing adoption of decentralized finance (DeFi)

platforms, which facilitate financial transactions and services using

blockchain technology, reflects a broader trend towards using cryptocurrencies

for a range of financial needs. DeFi Pulse (2024) reports that the total

value locked in DeFi platforms has reached approximately $60 billion,

demonstrating substantial interest in using crypto for financial services.

On the Horizon

According to Deloitte’s 2021 Global Blockchain Survey: A

New Age of Digital Assets (Deloitte, 2021), around 40% of

traditional banking customers expressed interest in exploring or using

cryptocurrencies and blockchain technology for enabling end-user financial

transactions.

Sources indicate that the traditional banking world consists

of about 1.9 billion bank accounts holding more than $300 trillion. (World

Bank, 2024) (Bank for International Settlements, 2024)

An Obvious Opportunity – Transfer Payments

The global market for consumer transfer payments, which

includes various forms of money transfers such as remittances and peer-to-peer

transfers, is substantial. According to a report by Allied Market Research

(2023), the global money transfer and payment services market was valued at

approximately $1.7 trillion in 2022, with significant growth expected in

the coming years.

The share of cryptocurrencies in the consumer transfer

payments market is still relatively small compared to traditional methods.

However, it is growing rapidly. According to Chainalysis

(2024), global cryptocurrency transactions reached approximately $10

billion in 2023, with an increasing portion of these

transactions involving cross-border transfers.

Despite its growth, cryptocurrency still represents a small

fraction of the overall consumer transfer payments market. Statista

(2024) reports that cryptocurrencies account for roughly 0.6%

of the total value of global transfer payments, but this proportion is expected

to increase as adoption grows.

The usage of cryptocurrencies for transfer payments is

expanding. According to a Pew Research Center report (2023),

about 8% of adults who use cryptocurrencies have engaged

in transfer payments, indicating a growing trend but still a minor part of the

overall market.

Because YCCU is an international credit union, the ability

of members to move money across international boundaries is inherent. A joint

account, where one member is in one country and the other in another is the

most simple vehicle allowing the effect of a transfer payment without having

money leave the account, or paying any transfer fees. In a similar vein, many

credit unions provide simplified means for members to transfer money from one

member to another. While these would still be subject to AML and Bank Secrecy

Act (BSA) regulations, they would be less costly and less public than public

blockchain transactions.

There are many more potential use cases possible in this

space than we have room to discuss here. Each will be constrained by the risk

appetite and regulations of the YCCU.

Less Obvious Opportunity: Safe-Haven Currency Access

Financially distressed countries are creating the need for individuals

to move their money from their native currency into a safe-haven currency[i].

In the past safe-haven currency opportunities were accessible only to the most

wealthy. The wealthy would convert their wealth into gold or USD, then jet off to

Europe or the USA. Once there, they open a numbered account in Switzerland, or a

private banking account in the USA and deposit their wealth where the rule of

law prevails. Then, they are free to return to their native country and pursue

their objectives with the assurance that

they would not feel the full effects of the financial turmoil in their

native land.

The relentless penetration of the internet into nearly every

region of the globe brings access to safe-haven currencies within reach of more

people than has ever before been possible, even in many financially distressed

countries. The International Telecommunication Union reports that as of 2024,

around 64.5% of the global population has access to the internet. The

ITU's data provides insights into global connectivity trends and efforts to

increase internet access in underserved regions. (International Telecommunication

Union, 2024).

As of 2024, several countries are experiencing significant

financial distress as evidenced by indicators such as debt-to-GDP ratios,

economic instability, and default risks. According to the International

Monetary Fund (IMF) (2024), as many as 30 countries are considered financially

distressed or are experiencing high levels of debt distress. This includes

countries facing severe debt problems, high default risks, or significant

economic instability.

The financially distressed countries collectively represent

approximately 10% of the global population. This estimate is based on a

combined population of these countries compared to the total world population

of about 8 billion people (World Bank, 2024). Collectively, financially

distressed countries contribute roughly 5% of the world GDP. This figure

reflects their total economic output compared to the global GDP of

approximately $100 trillion (World Bank, 2024).

By creating an NCUA compliant credit union with an

international community, YCCU is poised to open a floodgate for international

monies flowing from native currencies into cryptocurrencies (i.e., BTC &

ETH) and thence into the universally recognized safe-haven currency, USD.

Exceptional Opportunity – Rule of Law

According to the IMF Global Financial Stability Report of

2024 (International Monetary Fund, 2024), the biggest issue deterring people

from embracing cryptocurrency today is regulatory uncertainty. This encompasses

concerns about legal frameworks, compliance, and the potential for adverse government

intervention.

Without robust regulatory frameworks, consumers may face

higher risks of fraud, scams, and financial loss. The lack of protections can

make people wary of entering the cryptocurrency space. (CFPB, 2024)

In contrast with the public perception that cryptocurrency

users are averse to government regulations, a 2024 study by Bitwise Asset

Management (Bitwise, 2024) found that 56% of cryptocurrency users

believe that clear regulatory frameworks would improve the market's legitimacy

and protect investors. According to a Chainalysis report (Chainalysis,

2024), 50% of users and investors are in favor of regulations that offer

clear guidelines without overburdening the industry.

This means that 50%

or more of the $1.5 trillion Crypto Econosphere is already desiring the

benefits of regulatory stability and the rule of law.

Benefits from the Rule of Law

In contrast with the “wild west” environment currently

prevailing in the Crypto Econosphere, YCCU offers members the refuge of

civilization. Within YCCU they enjoy significantly elevated protections and

trust that today are glaringly absent in the Crypto Econosphere.

The advantages to members of YCCU are significant:

- · 7X24, physically agnostic access to their monies via the internet

- · Deposits stored in the premier safe-haven currency of USD

- · Deposits protected by the rule of USA law

o

Predatory local governments are unable to seize

accounts without going through due process in US courts.

o

Bad actors are deterred by US systems and

regulations.

o

NCUSIF[i]

insured deposits.

- · Easy flow of assets between US national and international banks via standard transfer mechanisms for all fiat transactions accepting USD.

- · Easy flow of assets between USD and the world’s leading cryptocurrencies for non-fiat currency transactions.

Admittedly, YCCU is not for everyone. To open an account

will require full compliance with US KYC regulations. Moving money into an

account will require full compliance with US AML regulations. Bad actors will

not be enamored of YCCU.

Planning

Alternate Starting Points

There are two ways to create YCCU.

- 1) De novo: Create a new credit union specifically as your Crypto Credit Union.

- 2) Ex novo: Convert an existing credit union into your Crypto Credit Union.

Both alternatives must address the same essential obstacles.

While ex novo might appear to have an advantage by already being in operation, turning

an existing credit union into YCCU will likely require refiling and getting

regulatory approval for a new charter.

We believe that de novo YCCU will be the most likely path to

success, although we are prepared to guide a team through either approach.

Ex Novo YCCU

When converting an existing credit union into Your Crypto

Credit Union (ex novo), much of the heavy lifting on the regulatory side is

already done. However, this will, correctly, be seen as radical shift for an

existing credit union. You will need approval from your board and probably from

your members, as well. After all, when the dust settles, each of them will now

become a member of your DAO. Then, it will require you to convince the

regulators, just as you would have to for a de novo effort.

You may need to update your charter

and you will need to:

- · Convert your charter into a smart contract

- · Convert your membership into a DAO

- · Implement smart contract driven governance

- · Implement CUC™ on a blockchain

- · Implement smart-contract based accounts

- · Forge links with outside DeFi exchanges

- · Create your own inhouse exchange

De Novo YCCU

Creating a credit union in the United States involves several steps and

regulatory requirements designed to ensure the stability and integrity of these

member-owned financial cooperatives. The process begins with organizing a group

of potential members and developing a clear mission and business plan.

YCCU Members

We are proposing a native blockchain Credit Union that

bridges the analog world where we live and the digital world where we

transact. Legally organized and

domiciled in the United States with NCUA institutional oversight and insured

deposits but whose members are world citizens.

For Your Crypto Credit Union, the common bond establishing the community of

members is the desire to:

1)

Use cryptocurrencies as a means for saving and spending

2)

Need to easily transition funds from the blockchain into

US Dollars (USD), and vice versa

3)

Safe-haven currency tied directly to USD instead of

relying on unproven, opaque, and variable algorithms[i]

4)

Citizens of failed states needing to keep their wealth

safe from criminal elements

5)

Citizens of countries experiencing economic collapse

and hyperinflation

This will be your decentralized autonomous organization (DAO) which embodies

and enables your members.

Crypto Investors with substantial crypto wealth (Whales) may be members,

subscribers, or founders. They can provide a portion of their crypto to fund

the captive exchange of YCCU. They can benefit from a portion of the captive

exchange transaction fees. Less well-capitalized members may also contribute to

liquidity pools through the functional equivalent of certificates of deposit.

All members will benefit from the reduced transaction fees inherent in a

captive exchange, versus the public centralized and decentralized

cryptocurrency exchanges. Those with savings accounts may also participate in

the “profit” portion of the exchange fees which come back to YCCU. Since YCCU

is a non-profit organization, these will appear as dividends on savings

accounts, just as the profits in any other credit union does today.

Charters

Old School and New School Charters

The initial step in forming a credit union is the establishment of a charter

and submitting it to either the National Credit Union Administration (NCUA) for

a federal charter or to the appropriate state regulatory authority for a state

charter. The application includes a detailed business plan, financial

projections, and evidence of the common bond among potential members (National

Credit Union Administration, n.d.).

As of today, creating the YCCU charter means writing one up the way they

have been done for several decades, and faithfully converting that into

something that can also be used to run YCCU. The first charter, the old-school

one, is for the consumption of regulators, the non-crypto world, et al. The

second, new-school charter, is not only for the consumption of regulators, the

crypto world, et al, it is also a key element in running the business of YCCU.

It is the charter and controlling contract for your DAO.

Creating the Charter

Credit unions are cooperatives, meaning they are

member-owned and operated. Federally chartered credit unions must have an

NCUA-approved field of membership, which is the legal description of the

persons, organizations, and other entities the credit union will serve. We are

proposing a DAO be created to encapsulate the Credit Union’s purpose and core

values, field of membership, capital funding plan, and subscribers[ii].

NCUA requirements fit neatly into DAO best practices

1)

Define the structure of the DAO project[iii],

2)

Decide the type of DAO,

3)

Decide DAO Token: Supply, allocation and

incentives,

4)

Create DAO,

5)

Create DAO Treasury[iv].

The charter for Your Crypto Credit Union must be brought to life in the form

of a smart contract. This smart contract, which is a computer program, will

both embody the terms of the charter and automate the execution of some of the

key elements of the charter.

Creating a charter in the form of a smart contract is not a trivial

exercise. It requires a combination of expertise and experience with credit

unions and with building and implementing smart contracts. Furthermore, simply

knowing how to create a smart contract isn’t sufficient. The charter as smart

contract must be integrated into the blockchain architecture of the whole

enterprise of YCCU. Blockchain

architects aren’t very common. Because the rise of the blockchain is relatively

new the skillset isn’t specifically taught in schools and not many people have

developed the relevant skills and necessary contextual intelligence.

Fortunately for you, if you are reading this article, then you know at least

one: the author.

Federal or State Charter

Although the Federal Government, in the form of the US Treasury Department,

Comptroller of the Currency, and other financial regulatory entities has not

been especially prompt in developing and deploying clear laws and regulations

around cryptocurrency, a federally chartered YCCU is optimal. YCCU should be legally

organized and domiciled in the United States with NCUA institutional oversight

and insured deposits but whose members are world citizens.

The Federal charter streamlines regulation and elevates regulatory

requirements onto the same level as international financial regulations. This

will lend credibility and confidence that YCCU is a legitimate institution,

recognized by the US Government and operating within the secure shelter of its

rule of law.

Technology and legal infrastructures exist today to complete this organizational

phase.

Domiciling YCCU

In one sense YCCU is domiciled in the Crypto Econosphere.

However, that is not enough. YCCU needs a legal presence within the USD

Econosphere. This legal presence is the bridge that brings the rule of law into

the Crypto Econosphere.

Physical Domicile

Currently, there are several states within the United States

of America, which have already established laws designed to create a legal

framework for the Crypto Econosphere. Laws recognizing and governing the legal

framework of the decentralized autonomous organization (DAO) and digital

currencies are the most relevant to YCCU. As of 2024, Wyoming, Tennessee,

Nebraska, and Florida have made significant strides in this area. The

forward-thinking demonstrated by these states is critical for the creation of

YCCU.

Wyoming has been at the

forefront of DAO legislation. It was the first state to legally recognize DAOs,

allowing them to register as limited liability companies (LLCs). This legal

framework provides DAOs with a formal structure and the ability to operate

within the bounds of state and federal laws while offering limited liability

protections to their members. This move is intended to attract blockchain-based

businesses to the state by providing a clear regulatory environment (Global

Fintech & Digital Assets Blog, 2024).

Tennessee has followed Wyoming's lead

by enacting similar legislation that allows DAOs to be recognized as LLCs. This

legislation provides clarity and a legal framework for DAOs operating within

the state, helping to foster innovation in the blockchain sector (Mondaq,

2024).

Nebraska has also made significant

regulatory advancements with the Nebraska Financial Innovation Act. This act

sets out guidelines for digital asset depositories, allowing them to offer

services such as digital asset custody, issuance of stablecoins, and use of

blockchain technologies for payment activities. Nebraska’s laws aim to provide

a supportive environment for blockchain innovators and expand financial

services within the state (Stevens Center for Innovation in Finance, 2024).

Florida has developed a comprehensive

approach to digital currencies. The state has defined virtual currencies under

its money transmission laws, requiring businesses dealing with digital

currencies to obtain the appropriate licenses. Additionally, Florida has a

Financial Technology Sandbox that allows businesses to operate with relaxed

regulatory requirements for a period, fostering innovation while ensuring

consumer protection (Bloomberg Law, 2024).

These states are leading examples of how local governments are adapting to

the evolving landscape of digital currencies and blockchain technology. Their

legislative efforts provide a framework that other states may look to as they

develop their own regulations in this rapidly changing field.

One, or more, of these states will need to be selected for the physical,

legal presence of YCCU in the USD Econosphere.

Digital Domicile

The YCCU charter will be embodied in a smart contract on

either the Ethereum Mainnet blockchain or the Bitcoin blockchain.

Rights, responsibilities, and privileges of YCCU

subscribers, management, and members will be built into publicly viewable smart

contracts which protect and enforce the rights, responsibilities, and

privileges with the emotionless, relentless, unsleeping, precise drive of the

computer programs they are.

Where Crypto and USD Meet

The USD Econosphere is undergirded with digital technology. Even

the most modest business or financial institution keeps it books in digital

ledgers. Captive technology teams, and independent technology companies alike,

offer suites of software applications to keep the books and integrate the business

operations with those books.

YCCU does not need to reinvent this wheel to succeed. It

only needs to make a modest adaptation.

A blockchain is an electronic ledger. YCCU only needs to

integrate blockchain records with existing general ledger (GL) tools and

banking systems to provide full-service offerings within both econospheres it

services.

Domiciling Summary

As the bridge between the econospheres, it is both legally

and functionally required that YCCU have a substantive presence in both. On the

one hand, YCCU has a physical presence in one or more states of the USA. This

physical presence provides the anchor for the rule of law. It establishes

jurisdiction, enforcement mechanisms, and protections for YCCU subscribers,

management, and members.

On the other hand, YCCU lives and breathes in smart

contracts on the major blockchains which are publicly viewable and

automatically enforced. Built in conformity with the laws of the USA, smart

contracts provide transparent and consistent application of the rules of the

YCCU.

Raising Capital

Once the charter application is approved, the next step is to raise the

initial capital. Credit unions typically raise capital through membership fees

and the sale of shares to their members. This capital is essential for funding

initial operations and providing the necessary reserves.

YCCU will be funded by seven subscribers who become the initial seven

governing members of the YCCU DAO. To fund YCCU, collectively they will donate a

combination of BTC, ETH, and USD equivalent to 700 BTC. Having a treasury

anchored by the dominant cryptocurrencies is essential for the key

functionality of YCCU.

Under the Charter, there are provisions whereby those donations can be

converted into deposits. However, there is no precise timeline or definitive

trigger for that conversion. Rather, it is conditional based on successful

operations of YCCU.

It is worthwhile to point out here that one of the common scams in the

Crypto Econosphere is something called a “rug pull[v].”

The commitment of these funds as a donation by the subscribers is both legal

and operational protection preventing YCCU from becoming a rug pull (see Private,

Regulated Blockchain

elsewhere in this document).

Governance

Credit Unions organized and domiciled in the United States are required to

have operational organizations supported by-laws, management plans, general

ledger, and all required policies[vi]

for operations. Additional nice to have artifacts include mission statement,

proposed products and services, physical HQ location and marketing plans. Where

practical, these governance documents will be built as smart contracts.

Particularly for policies, this allows a direct, programmatic application of

policies into the systems and practices of YCCU.

In addition to raising capital, the organizers must establish a board of

directors and other governance structures to oversee the credit union's

operations. The board is responsible for setting policies and ensuring that the

credit union operates in the best interests of its members (Credit Union

National Association, 2021).

YCCU DAO members will vote for the board members using cryptocurrency

enabled technology, and controlled the YCCU smart-contract-charter. This

technology enables secure voting from anywhere in the world with an internet

connection. Essentially, this moves some of the most basic parts of corporate

governance of credit unions from the nineteenth century into the twenty-first

century.

Regulatory Compliance

Regulatory compliance is a critical aspect of creating and operating a

credit union. Federally chartered credit unions must adhere to regulations set

forth by the NCUA, while state-chartered credit unions must comply with state

regulations. These regulations include requirements for maintaining adequate

capital, ensuring the safety and soundness of the institution, and protecting

member deposits through insurance provided by the National Credit Union Share

Insurance Fund (NCUSIF) (NCUA, n.d.). Additionally, credit unions must

implement robust risk management practices, including internal controls,

audits, and compliance programs to address issues such as know-your-customer

(KYC), anti-money laundering (AML) and consumer protection.

These by-laws and regulations are required to operate a responsible

financial operation. All support operating a blockchain-native credit union.

Additional and modified bylaws should be considered to support tokens, crypto

treasury assets, rug pull restrictions and other unique elements of operating

on a blockchain.

YCCU must build or acquire these regulatory tools as part of the costs of

doing business. Fortunately, tools to aid in these compliance efforts are

rapidly maturing in the crypto world. Because of certain quirks of the

blockchain, many of these crypto-based tools are faster, more reliable, more

probative, and less labor intensive than their non-crypto alternatives.

As an example, because of the public nature of blockchain records, whenever

any member is trying to deposit funds in their YCCU account, the sources of

those cryptocurrency deposits can quickly be traced backwards through several

generations of transactions to identify any that might have originated through

a known exploit[vii].

These back-traces are usually accomplished in seconds, without any manual

intervention. The results can be automatically screened, and appropriate

policies, procedures, and regulations applied. This level of automation

dramatically decreases the cost and time required for AML compliance, while

significantly increasing the diligence and accuracy of the process.

Building Trust

Finally, ongoing education and outreach are essential for the success of a

credit union. This involves educating members about the benefits and services

offered by the credit union and encouraging their active participation. Credit

unions thrive on member involvement and feedback, which help shape policies and

services that meet the needs of the membership. Community engagement and

financial education initiatives can also help attract new members and build a

strong, loyal member base (National Credit Union Administration, n.d.).

YCCU will likely have a level of engagement from the member base that will

be the envy of any Co-op organization. The crypto community is probably the

most technologically interconnected and communicative community in the world.

Your success, and your failures, will likely be touted far and wide to both

members and non-members around the world, all in a matter of seconds.

Unlike traditional credit unions, YCCU governance and treasury functions reside

on public blockchains. The transparency of your operation will be on display

for the whole world, almost in real time. If that level of transparency doesn’t

build trust, nothing will.

De Novo Summary

In summary, creating Your Crypto Credit de novo in the USA involves a series

of well-defined steps, including organizing potential members, obtaining a

charter, raising capital, establishing governance structures, and ensuring

regulatory compliance. Ongoing member education and community engagement are

also crucial for the growth and sustainability of the credit union.

The Iceberg: Managing Crypto Assets

One of the biggest risks banks, and by extension credit

unions, face today regarding cryptocurrencies is how to carry them on their

books. Most institutions want to find a way to carry them as deposits. Therein

lies the problem, and the solution.

The Problem

Almost without exception today, cryptocurrencies are

speculative in nature. As such, their valuations are subject to extreme, and

extremely rapid, value changes. This makes it nearly impossible for regulators

and risk managers to create realistic reserve requirements for these

cryptocurrencies.

Arguably, it was exposure to volatile cryptocurrency

accounts as deposits which led to the failures of both Silvergate and Signature

banks

Dodging the Iceberg

YCCU avoids the volatility risk of cryptocurrencies. It

won’t hold volatile cryptocurrencies as deposits. Credit Union Coin™ (CUC™) is

the only cryptocurrency YCCU will hold in member accounts. CUC™ is fully backed,

dollar for CUC™, by credit union deposits in US dollars (USD).

Although YCCU members can deposit ETH, BTC, or USD, all are

immediately converted into CUC™ and 100% reserved with USD. To be clear, the

reserve is USD, not treasuries or other near-liquid forms of USD.

As with all rules, there is an exception.

The Exception

Like most credit unions, YCCU will offer members three types

of consumer accounts: demand deposits, savings accounts, and time deposits.

Checking accounts receive no dividends.

Savings accounts (AKA Share Accounts), accounts falling

under “Reg D”, will earn a very modest dividend return, just as most savings

accounts in credit unions earn today. On any given day, the liquidity backing

these demand deposits may be less than, or more than, 100%. Demand deposits are

often used by financial institutions to fund very short-term credit vehicles.

The spread between the interest charged on these short-term credit vehicles and

what is paid to the members is revenue to YCCU.

Time deposits, such as certificates of deposit, provide a

greater return for the depositor in exchange for a commitment to allow YCCU to

use the money for lending against medium and long-term credit vehicles. In the

cryptocurrency world, there are very striking similarities between time

deposits and “staking.”[i]

(Buterin, 2014) (Wood, 2014) (Narayanan et al, 2016)

A Gordian Knot - Lending

The issue of extending credit in the Crypto Econosphere is

complicated. Answering it completely requires members, directors, and managers

to agree on risk thresholds and risk management.

The Nancy Reagan Model of Lending

In 1985, Nancy Reagan, wife of then President Ronald Reagan,

launched the “Just Say No” campaign to combat recreational drug use (Reagan,

1985), encouraging children and adolescents to refuse drugs and resist peer

pressure.

Likewise, YCCU can embrace the Nancy Reagan model when it

comes to lending. The simplest answer is “no.” Totally avoiding the risks

associated with any sort of lending is the easiest way to avoid lending

losses. However, that simple answer

deprives YCCU members of one of the significant benefits of a typical credit

union. Traditionally, the credit union has been the premier micro-lender for

small businesses as well as a significant source of consumer credit.

If You Don’t Need It, We Will Lend It

The fact is that, when you boil down most credit policies to

their bones their essence is that if the borrower can show that they don’t need

the loan, we will lend the money.

This is the next, most simple answer. Only offer 100%

secured credit. This is a very low-risk approach to lending. Secured lines of

credit and secured loans are wonderful ways for members to increase their

credit scores. However, they seldom meet the credit needs of most members.

Wholesale Lending

The third best alternative, in terms of minimizing risk, is

to adopt a wholesale lending model where YCCU originates loans conforming to

prearranged credit standards and then sells those loans to a third party. Under

this well-proven model, YCCU capital is only used for short term funding of

loans. The financial rewards to YCCU are modest, and in line with the modest

amount of risk associated with providing short-term funding.

Collateralized loans are probably the most common credit

vehicle offered by banks and credit unions today, both for portfolio and

wholesale lending. However, risk ratings associated with collateralized loans depend

heavily on the ability of the lender to take possession of the collateral. With

an international membership base, offering collateralized loans would require

YCCU to navigate property rights in jurisdictions all over the world. Wherever

the rule of law is weak, property rights laws quickly decompose into the old

maxim that “possession is nine-tenths of the law.”

Securities Lending Model

When it comes to collateralized lending in the international

sphere YCCU may be best advised to borrow the securities-based lending model used

by banks today. Lend no more than 50% of the value while constantly monitoring

the value of the security and liquidating the collateral to repay the loan if

the value drops too far. Securing the collateral into a smart contract automates

the relationship and the agreement, dramatically reducing risk. Treating

cryptocurrencies like securities, for collateralized lending purposes, seems

like a natural fit.

Unsecured Lending

Unsecured loans are always high risk and should generally be

avoided. However, YCCU could transfer this risk by doing what many banks and

credit unions already do; partnering with credit card providers who underwrite

the line of credit and carry the risk.

Gordian Summary

The members of YCCU, through their board of directors, will

need to decide their credit policies and procedures, and offer (or not)

products accordingly. While this is a challenging issue for every credit union,

for YCCU this is an especially tangled issue. The international membership of

YCCU, even operating under the nominal umbrella of US law, significantly

complicates risk management by multiplying the jurisdictions where collections

efforts might be required.

Transferring those jurisdictional risks through wholesaling

is one significant element of the solution. The other is to limit portfolio

lending to what YCCU can reasonably be expected to control, cryptocurrency.

YCCU Econosphere and Architecture

Econospheres Defined

The financial equivalent of an ecosphere can be thought of as a financial

ecosystem or an econosphere. Just as an ecosphere includes

various interconnected organisms and environmental factors that create a

balanced, self-sustaining system, an econosphere consists of various

interconnected financial entities and elements that interact to create a

functioning economic environment.

The term "econosphere"[ii]

generally refers to the integrated system of economic activities and processes

within a particular region or on a global scale. It encompasses all economic

interactions, institutions, and systems that contribute to the functioning and

development of the economy (Drexler, 2020).

Explanation:

The econosphere represents

the interconnected network of economic entities, including businesses,

governments, markets, and consumers. It highlights the interdependence of

economic activities and the flow of goods, services, and capital. This concept

can be used to understand how various economic factors and actors influence and

sustain economic systems (World Bank, 2021)[iii].

Key Components of an Econosphere:

- Financial

Institutions: Banks, credit unions, investment firms, and

insurance companies that provide financial services and products.

- Market

Participants: Individuals, businesses, and institutions

that engage in financial transactions, including investors, consumers, and

corporations.

- Regulators

and Authorities: Government agencies and regulatory bodies

that establish and enforce financial laws and regulations to ensure

stability and integrity.

- Payment

Systems: Infrastructure and technologies that facilitate

transactions, such as digital wallets, payment processors, and blockchain

networks.

- Financial

Products: Assets and services offered within the

ecosystem, including loans, insurance, stocks, bonds, and

cryptocurrencies.

- Technological

Innovations: Fintech companies and platforms that drive

advancements in financial services, such as robo-advisors, peer-to-peer

lending, and blockchain technology.

Characteristics of an Econosphere:

- Interconnectedness:

Components of the financial ecosystem are interrelated, with changes in

one part affecting others. For example, shifts in interest rates can

impact investment returns and borrowing costs.

- Adaptability:

The ecosystem adapts to changes in regulations, technological

advancements, and market conditions, similar to how an ecosphere adapts to

environmental changes.

- Self-Regulation:

Within a financial ecosystem, market forces and regulatory frameworks work

together to maintain stability and prevent systemic risks, akin to how

natural ecosystems self-regulate to maintain balance.

In essence, an econosphere is a dynamic, interconnected network of financial

entities and processes that work together to support economic activities, much

like an ecosphere supports diverse forms of life within its environment.

Competing Econospheres

On a global level there currently exist three major

econospheres.

- 1) USD

- 2) Cryptocurrency (Crypto)

- 3) BRICS[iv]

Although I call these ‘major’ econospheres, based on their

respective scales USD is a major econosphere. BRICS and Crypto aspire to be

competitive, parallel econospheres. Both BRICS and Crypto[i]

are expressly driven by the desire to replace, compete with, or operate in

parallel with USD.

Unlike BRICS and USD, the Crypto Econosphere is not built on

a fiat currency. Instead, it is built on utility currencies; primarily Bitcoin

and Ethereum. The value of these utility currencies is set by the market

instead of by government dictates. While this frees the Crypto Econosphere from

many of the distortions inserted by governments, it also makes these currencies

much more volatile than the major fiat currencies of the world (e.g., USD, Yen,

Franc, Euro, Yuan, Ruble, Rupee, etc.).

The YCCU econosphere, as noted elsewhere, intentionally is a

bridge between USD and Crypto[ii].

The architecture of the business and YCCU’s enabling

technology seamlessly connects the two econospheres. Consistent with general

trends in banking, for YCCU brick and mortar branches are not a significant

component for the success of the endeavor. Rather, digital banking will be the

vehicle which nearly all members of the YCCU will use, by both preference and

necessity. (Accenture, 2023) (Deloitte, 2022) (KPMG, 2021).

Building Blocks

Being a bridge between the USD and Crypto econospheres means

the YCCU must address the state and integration of the elements of both.

USD Econosphere Building Blocks

The technological and operational building blocks of the USD

econosphere are both well-established and emerging with new capabilities. Most

notable and relevant for this discussion is the current and emerging

capabilities of FinTech[iii]

into the USD econosphere.

Crypto Econosphere Building Blocks

While a few minor elements of the Crypto Econosphere are

emerging right now, the bulk of them have been in the market for several years

and adoption puts YCCU in a fast-follower situation instead of being on the

“bleeding” edge. This translates into a substantial reduction of operational

risks for YCCU.

The technological building blocks of the Crypto Econosphere

are blockchains, smart contracts, DeFi, dApps, and Web 3.0.

Web 3.0 defines a computerized architecture which, like

YCCU, can operate seamlessly in both USD and Crypto econospheres. With CUC™ an

internet user (YCCU member) can interact with YCCU through a Web 3.0 front end

and move back and forth between Crypto and USD with very little friction.

Today, Bitcoin (BTC) and Ethereum (ETH) are the two leading

blockchains and cryptocurrencies in the world. Both have weathered and survived

a wide variety of attacks by bad actors. They have adapted and proven to have

evolved into nation-state security features. Recently, US regulators have

categorized both as commodities, removing substantial regulatory uncertainty.

Regulatory stability, security, resilience, and widespread adoption are all

foundational features which will significantly enable the success of YCCU and

CUC™.

Building the YCCU treasury with BTC, ETH, and USD is

critical to create and maintain liquidity across the YUCC ecosphere.

Captive Crypto Exchange

As mentioned elsewhere, the Bitcoin and Ethereum blockchains

are not cross compatible. Converting (exchanging) USD for BTC or ETH without

the correct technology will literally result in money being lost, as surely as

though it were tossed into the ocean.

Transaction costs (exchanges rates and “gas fees”) and some

fundamental technology components to convert between BTC and USD are distinct

from those required to convert between ETH and USD. To convert money between

BTC and ETH requires both technologies and an intermediary. YCCU and CUC™ put

all this technological complexity into the background and make it irrelevant

for most YCCU members.

When the Federal Reserve Bank of the United States rolls out

a blockchain based Central Bank Digital Currency (CBDC) it will be readily

integrated into the YCCU architecture.

YCCU Treasury

The YCCU treasury is built on BTC, ETH, and USD. CUC™ is, literally,

the common denominator across these currencies. CUC™ is a USD equivalent

cryptocurrency with a one-to-one backing with USD deposits held by YCCU. CUC™

resides on a YCCU private, proprietary blockchain[i].

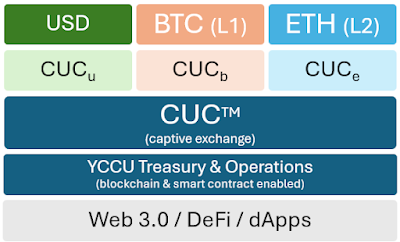

YCCU deploys three “flavors” of CUC™.

- . CUCu™: This is CUC™ programmed to be compatible with USD.

- . CUCb™: Programmed to be compatible with the Bitcoin blockchain.

- . CUCe™: Compatible with the Ethereum blockchain.

Operationally, when a depositor deposits BTC, ETH, or USD,

they are converted to CUCu™. In the background, this means that YCCU

converts the deposit through the equivalent of a captive cryptocurrency Forex

from the deposit currency into USD and represents the deposit as CUCu™.

Exchange fees, distinct from gas fees, in the exchange are retained by YCCU.

Both gas fees and exchange fees decrease the net deposit to the member.

Although the treasury retains BTC and ETH, those balances

are not used to sustain the liquidity of the deposits base. Including them in

the deposits base would expose YCCU liquidity to all the volatility of those

currencies.

When a YCCU member wants to make a withdrawal, they can

withdraw directly into CUC™ or they can exchange CUC™ for BTC or ETH, directly

through YCCU. Likewise, they can deposit BTC or ETH into YCCU and it will

automatically be converted into CUC™.

YCCU will not denominate deposits in BTC, ETH, or CUC™. Nor

will it hold custody of BTC or ETH for members. I repeat. When a member

deposits BTC or ETH into a YCCU account, the deposit is immediately converted

into CUC™ and credited to the member account as USD.

Conversion of all accounts into CUC™ is critical to protect

the liquidity of YCCU from the volatility of BTC and ETH. Conversion to CUC™ limits

the liquidity of deposits solely to fluctuations of the fiat (USD) currency.

Creation and Destruction of CUC™

Creating CUC™

In the USD Econosphere and the Crypto Econosphere, the

creation of money is called ‘minting.’ Whenever YCCU receives a deposit, it

mints the appropriate amount of CUC™ to represent the USD denominated value of

that deposit.

Destroying CUC™

In the USD Econosphere, when paper currency gets worn or

damaged it is gathered up and sent to a secure facility where it is burned. In

the Crypto Econosphere, digital currency never gets damaged or worn.

Regardless, there are still situations where it needs to be destroyed.

Destroying cryptocurrencies is called ‘burning.’

Whenever YCCU processes a withdrawal, it converts the CUC™

into the preferred currency for withdrawal and then it burns the CUC™ which has

just been drained of its value through the withdrawal.

‘Domestic’ CUC™

Minting and burning CUC™ in direct proportion to the USD

value of deposits and withdrawals, respectively, is essential to eliminate the

possibility of CUC™ becoming inflated, or depreciated in value relative to USD.

The alternative approach, which we reject, is an algorithmic

approach such as are currently used by most so-called stable coins which are ‘pegged’

to USD. The fact that their exchange rates are frequently greater or less than

one US dollar betrays the underlying unreliability of their algorithms. The

collapse of the Terra-Luna stablecoin shows that the algorithmic stable coins are

vulnerable to catastrophic collapse when stressed (Liu, 2023).

This strict requirement to limit the amount of CUC™ to

correspond 100% to the amount of USD reserved is why YCCU members cannot put

CUC™ into a self-custody wallet. From a self-custody wallet, the CUC™ could be

exchanged with parties who are not YCCU members. This would put CUC™ into ‘the

wild’, beyond the control of YCCU.

‘Wild’ CUC™

While there may arise algorithmic methods which promise to allow

CUC™ into the broader Crypto Econosphere without causing inflation, algorithms

are only as reliable as the minds of the people who devise them and the skills

of the people who implement them into code. Rather than relying on the

implementation of a complicated algorithm to prevent the inflation of CUC™ as

they leave YCCU and go into the wild, the safest and simplest approach is to

not permit them to go beyond the custody of YCCU, and ensure that each CUC™ is

100% backed by USD reserves.

Wallets v Accounts

Digital Wallets

In recent years, digital banking has innovated digital

wallets (e-wallets). E-wallets[ii]

are designed to limit the financial damage which can be done to a customer by

‘walling off’ the wallet from direct access to the customer accounts.

Unfortunately, the notion of e-wallets causes significant confusion when

discussing crypto wallets. Both e-wallets and crypto wallets are often lumped

together under the generic term of digital wallets. Unfortunately, that

imprecise language obscures important differences between the various kinds of

digital wallets.

e-Wallets (Banking)

- Usage:

Primarily used for traditional banking transactions, online purchases, and

managing bank accounts. Examples include Apple Pay, Google Wallet, and

PayPal.

- Integration:

Linked to bank accounts or credit/debit cards, and often offer seamless

integration with financial institutions.

- Security:

Employs encryption and multi-factor authentication to protect user

information.

Cryptocurrency Wallets

Cryptocurrency wallets are designed specifically for storing

and managing cryptocurrencies like Bitcoin and Ethereum. Examples include

hardware wallets (e.g., Ledger, Trezor) and software wallets (e.g., MetaMask,

Trust Wallet).

- Integration:

Typically, not linked to traditional bank accounts but to blockchain

networks. Users manage private keys to access their cryptocurrencies.

- Security:

Involves private key management; hardware wallets offer high security by

storing keys offline, while software wallets are more vulnerable to online

threats.

Custody Matters

Custody refers to who has access and possession.

Understanding custody clarifies whether a wallet is really a wallet, or a

sub-account.

Wallets, both in Crypto and USD are differentiated from

accounts based on custody. Accounts are ledger entries against a fund whose

custodian is a financial institution. Wallets, in contrast, are in the custody

of the individual who owns or possesses the wallet.

Some exchange providers, e.g., Coinbase, Binance, etc.,

offer centralized custody of “wallets.” Although these providers refer to these

as wallets, they are merely specialized ledger entries, and the institution

still has custody of the funds and can deny or restore access to these

so-called wallets.

True crypto wallets, like their physical counterparts,

always have the characteristic of being solely in the custody of the possessor.

This means that when YCCU transfers a customer balance into a wallet, that

balance (and the monies it represents) exit the balance sheet and custody of

YCCU.

Self-custody: If you lose it, your monies are gone.

- · Physical Wallets (e.g., the billfold in your pocket, or purse). Used to carry physical cash, credit/debit cards, and identification. It’s a tangible object rather than a digital tool. Vulnerable to theft or loss; lacks digital security features such as encryption or biometric authentication.

- · Hardware crypto wallets: hardware wallets offer high security by storing keys offline. Vulnerable to theft or loss. If the cryptographic key is not compromised, the contents of a hardware crypto wallet will not be accessed by anyone not having the key.

- · Software crypto wallets: software wallets are more vulnerable to online threats. However, if the cryptographic key is not compromised, the contents of a software crypto wallet will not be accessed by anyone without the key.

Central-custody: When an institution has custody of

funds, regardless of the choice to refer to some accounts as e-wallets, or

crypto-wallets, the financial institution can both seize, release, and restore

balances, as required by law and customs.

- · Accounts

o

E-wallets: sub-accounts designed to store fiat

currencies.

o

Software crypto wallets: sub-accounts designed

to store cryptocurrencies.

YCCU maintains accounts and may deploy e-wallets and

software crypto wallets with centralized custody for members. These sub-accounts

remain on YCCU books.

For a customer to move CUC™ into a self-custody wallet, it

is a withdrawal and must first be converted to another currency. Self-custody

assets are not deposits and are not carried on YCCU books.

Conclusions About Wallets and Accounts

To understand cash flows and regulatory responsibilities for

YCCU it is necessary to understand wallets and accounts.

All accounts, regardless of what they are called, are

centralized custody products. They are carried in YCCU books and YCCU bears

regulatory responsibility for those accounts.

In contrast with accounts, YCCU has no custody of wallets

and bears no accounting or regulatory responsibility for those balances.

Who Will Build YCCU?

To make YCCU a reality requires a team of high-performing

individuals who bring a variety of things to the table.

We need Subscribers and Donors who bring both expertise and

money to the table. And, we need guides who understand how these two

econospheres can be bridged.

Subscribers and Donors

Subscribers[iii]:

We are looking for seven, or more, subscribers who are ready to lead the USD

and Crypto Econospheres into the next level of growth.

Donors: We are looking for cryptocurrency investors

and USD investors who are ready to bring financial civilization to the

wilderness of the Crypto Econosphere. Some may become both subscribers and

donors.

In the context of credit unions, the term "donors"

typically refers to individuals or entities that contribute funds or resources

to help establish and operate a new credit union. These donors may benefit in

several ways, although their motivations and rewards are different from those

of investors in for-profit enterprises.

Donations

When a credit union receives donations, these contributions

are typically accounted for in specific ways, depending on the nature of the

donation and its intended use.

Donations to support the formation of a credit union may be

eligible for tax deductions, depending on the nature of the donation and the

donor’s tax status. This can provide financial benefits through reduced taxable

income. (IRS, 2024)

Here’s a breakdown of how different types of donations are

categorized and managed:

Gifts

Donations made to a credit union

are usually considered gifts. These are voluntary contributions provided

without any expectation of repayment or return. (CUNA, 2024)

Gifts are recorded as income in

the credit union’s financial statements. They are typically classified under

"contributions" or "donations" in the income section. Gifts

can be used to cover initial capital requirements, operational costs, or

specific projects.

Endowments

If the donation is intended to be

held in perpetuity or invested to generate income over time, it may be

classified as an endowment. This is less common for credit unions but can occur

if donors specify that their contributions should be used to generate ongoing

support.

Endowments are usually recorded as

a separate fund within the credit union’s financial statements. The principal

amount remains intact, and only the income generated from the endowment may be

used for operational purposes or specific projects. (AICPA, 2024)

Loans

Donations are not typically

structured as loans. Loans involve an agreement for repayment with interest,

which is not characteristic of donations made to credit unions. However, if a

donor provides funds with the expectation of repayment, it might be considered

a loan rather than a donation.

If funds are provided as a loan,

they are recorded as a liability on the credit union’s balance sheet. The

credit union would account for repayments and interest payments as specified in

the loan agreement. (FASB, 2024)

Staking

A portion of the donations may be treated similarly to CDs. In the Crypto Econosphere this is called staking. These portions of the donations are used to fund the liquidity pools of the captive exchange. When BTC/ETH/USD are converted to CUC there is a transaction fee. Likewise, when CUC™ are converted to BTC, ETH, or USD there are transaction fees. When donations are used to fund those exchange liquidity pools, a portion of the transactions fees are paid to the donors. The remainder is retained as earnings to YCCU.

As

the financial domain of YCCU expands inside the Crypto Econosphere, the value

of exchange transactions will grow apace. This will provide a substantial

ongoing cash flow to the donors.

Deposits

Under the rules of YCCU (and most credit unions) there are mechanisms where, over time, donations can be converted into deposits.

While

founders don’t directly receive profits like shareholders in a for-profit

entity, they benefit from any profit-sharing or dividends distributed to

members. These distributions are based on the credit union’s overall financial

performance and are shared among all members, including founders. (Credit Union

Journal, 2024)

Donations Summary

Donations to a credit union are primarily accounted for as

gifts or contributions, recorded as income in the financial statements. They

may also be classified as endowments if specified by the donor to generate

ongoing support. Donations are generally not considered loans, or staking, as

they are given without the expectation of repayment.

Donors to a credit union can benefit from community impact,

enhanced reputation, potential tax benefits, strategic business opportunities,

and future involvement in the credit union. While these benefits are generally

less direct compared to financial returns in for-profit ventures, they align

with the mission-driven nature of credit unions and the broader social and

economic goals they serve.

How are Donations Used

When donors contribute financial resources to help found a

credit union, their contributions are used in several specific ways to ensure

the successful establishment and operation of the institution. Here’s a

detailed breakdown of what typically happens to these financial contributions:

Initial Capital and Reserve Requirements

The donations are often used to meet the initial capital

requirements set by regulatory authorities, such as the National Credit Union

Administration (NCUA). This capital is essential for starting operations and

ensuring the credit union has sufficient resources to cover early operational

costs and absorb potential losses. (NCUA, 2024)

Operational Costs

Funds are allocated to cover the initial setup costs, which

include legal fees for forming the credit union, obtaining necessary licenses,

and complying with regulatory requirements. Other operational costs include

office space, technology infrastructure, and initial staffing. (CUNA, 2024)

Regulatory Fees

A portion of the contributions is used to pay for regulatory

fees associated with the application process. This includes fees for reviewing

and processing the credit union’s charter application, as well as any ongoing

compliance costs. (Credit Union Journal, 2024)

Community and Member Outreach

Some of the donated funds may be used for community outreach

and marketing efforts to attract members and build a customer base. This

includes educational campaigns about the credit union’s benefits and services,

as well as efforts to engage the local community. (Credit Union Times, 2024)

Building Financial Stability

Donations help build financial reserves that provide a

safety net for the credit union. This ensures the credit union can operate

sustainably and remain solvent, even if it faces financial challenges in its

early years. (BIS, 2024)

Donations Usage Summary

The financial contributions from donors founding a credit

union are primarily used to meet initial capital and reserve requirements,

cover operational and setup costs, pay regulatory fees, fund community

outreach, and build financial stability. These expenditures are crucial for

establishing a sound and effective credit union that can serve its members and

fulfill its mission.

Intangible Benefits to Donors and Subscribers

In addition to the material benefits that accrue to donors

and subscribers, there are intangible benefits.

Community Impact

Donors may derive significant satisfaction from contributing

to a credit union that supports community development, financial inclusion, and

economic empowerment. By helping to establish a credit union, donors can

positively impact underserved or economically disadvantaged communities. (CUNA,

2024)

Personal or Corporate Branding: Enhanced Reputation

Donors, particularly corporate donors or philanthropic

organizations may benefit from enhanced reputation and positive branding.

Supporting the creation of a credit union can align with corporate social

responsibility goals and improve public relations. (HBR, 2024)

Business and Networking Opportunities

For businesses or individuals with strategic interests in

the financial sector, contributing to a credit union may provide networking

opportunities and foster relationships with other stakeholders in the industry.

(Financial Times, 2024)

Membership and Influence:

Donors who are also potential members might benefit from

future involvement in the credit union. They could have influence over its

operations, benefit from its financial products, or participate in governance

if they become members. (NCUA, 2024)

Donors and Subscribers Summary

There are many tangible and intangible benefits deriving

from being a founder of YCCU. The founders of the Transcontinental Railroad,

Leland Standford, Collis Huntington, Mark Hopkins, Charles Crocker, Thomas

Durant, and Grenville Dodge became wealthy, famous, and highly influential. On

their heels came Cornelius Vanderbilt who transitioned from steamships to

railroads in the 1860s to become one of the richest men in US history.

(Ambrose, 2001).

YCCU promises in 2024 to do for the Crypto Econosphere and

the USD Econosphere what the Transcontinental Railroad did for the Western

Frontier and the Eastern United States of America in the 1860s.

Now is the time to get on board.

Guides

With the vision, blockchain, and financial industry experience of Gilman Patrick, LLC and The Skillful PM, LLC you can build a financial legacy that will stand as a monument for as long as the metaverse exists.

Don't Miss These Related Articles:

Lebanon: How a Crypto Credit Union Can Help You Survive a Failed State

https://www.gilmanpatrick.com/lebanon-crypto-credit-union-solution/

Notes

[i] Keeping CUC™ on a

proprietary blockchain, instead of on a public blockchain, is required to

protect the financial privacy of YCCU members. All transactions on a

public blockchain such as Bitcoin and Ethereum are publicly viewable.

[ii] Digital wallets (also

known as e-wallets) are software applications that store payment information

and facilitate electronic transactions. They can be used to make purchases

online, transfer money, and manage payment methods. In modern banking, digital

wallets integrate with banks and financial institutions to provide convenient

access to funds and streamline payment processes. They often include features

like contactless payments, transaction history, and security measures such as

encryption and biometric authentication.

[iii] “subscribers” = a team

of people to help the credit union start (https://ncua.gov/support-services/credit-union-resources-expansion/starting-new-federal-credit-union

)

[i] The desire to use

cryptocurrencies to replace traditional fiat currencies such as the USD is a

topic of significant discussion in the financial and technological sectors.

Here are some quotes and citations reflecting this desire:

"Cryptocurrencies have the potential to replace

traditional fiat currencies as they offer a decentralized and secure

alternative to the current financial system" (Tapscott & Tapscott,

2016, p. 245).

"The move towards a decentralized financial

system, driven by cryptocurrencies, is seen as a way to mitigate the risks

associated with central banking and fiat currencies" (Narayanan et al.,

2016, p. 12).

"Cryptocurrencies challenge the traditional fiat

currency system by providing an alternative that can operate independently of